Residence for foreign investors in Spain.

The new Entrepreneurs´ Law includes the grant of a residence permit for Indians who invests in Spain, and this came into force in October 2013. The law says that non-resident aliens may obtain their residence permit provided that they have made a significant capital investment or purchase housing for at least €250,000. The Entrepreneurs´ Law says that a “significant” capital investment that meets one of the following requirements:

An initial investment of €2 million in Spanish public debt, or €1 million or more in shares or other capital interests in Spanish companies, or banking deposits in Spanish financial entities.

B) The purchase of housing in Spain must be made with an investment of €500,000 or more per applicant. The applicant must show and have available an investment in property of €500,000 free of encumbrances. The part of the investment which exceeds this amount may be the object of a charge.

C) An entrepreneurial project to be developed in Spain, and considered and shown to be of general interest, for which purpose and assessment is made of compliance with the at least one of the following conditions:

Creation of jobs.

Making an investment with social and economic impact of importance in the geographical ambit in which the activities to be undertaken.

Relevant contribution to scientific or technological innovation.

Procedure for requesting a residence permit in Spain for economic investments in property worth more than €500,000.

Valid only for non-EUcitizens, non-resident in Spain, at the time of investment.

Steps:

1. Processing of the investor NIE, with the rest of his family will need a Residence Card.

2. Purchase of the property worth at least €500,000 (free of encumbrances).

3. Processing and documentation to be compiled in Spanish territory within 60 days, application for a visa in the Spanish Consulate in the country of origin.

3.1. The foreign investor must open a current account Spanish bank with a branch in Spain, and deposit €5,560.52 for the applicant, and 100% of the IPREM €6290.13 for each other member of the family.

The amount should be equal to or greater than €250,000, for the purchase of property.

3.2. To have or to be exempted from a public or private sickness insurance in Spain, with an entity operating in Spain.

3.3. To request a certificate of title and encumbrances on the property register.

Important note. If, after 90 days, the property purchased is not registered, the purchaser must appear at the Spanish Consulate in the country of origin, with the rest of documentation, "Record of Presentation" of the deed for the property purchased and receipt for payment of taxes on the purchase.

4. Visa applications. The purchaser must go to the Consulate in the country of origin or residence with all the documents mentioned above, to present the related application of "Resident Visa", as investor, showing (in compliance with the "Money-Laundering Law"), the origin of the applicant´s income, justifying bank movements made in the last year, and providing the valid passport of the investor and all his relatives, and paying the related consular fees. It is possible that the Consulate will also ask for photographs, a criminal record certificate from the country of origin, or a certificate of good conduct and a medical certificate showing the absence of illness, both of the applicant and his family, if there might be an obstacle to travel to Spain.

5. Application for a Residence Permit. Once the Resident Visa has been granted, the holder must travel within 30 days to Spain, to request the Residence Permit. The Permit effectively allows him to reside in Spain for two years, without having to leave after 90 days. Subsequently, the purchaser may request a Resident Card as a non-community citizen, and after 10 years, Spanish nationality.

Comments on the Resident Card/Pemit in Spain.

The investor may enter Spain without a Visa from his country of origin, and may also enter any other Schengen country without a Resident Visa, for a maximum period of 90 days, which the governments concerned can check against flight data.

The passport will not be stamped, since this only happens when someone from outside the EU enters the first Schengen country.

The United Kingdom is not part of the Schengen area, and therefore cannot be entered with a Spanish Resident Card.

In general, the regime allows relatives of communities of EU citizens to enter without a visa, if they have an EU Family Card in Spain.

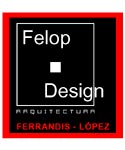

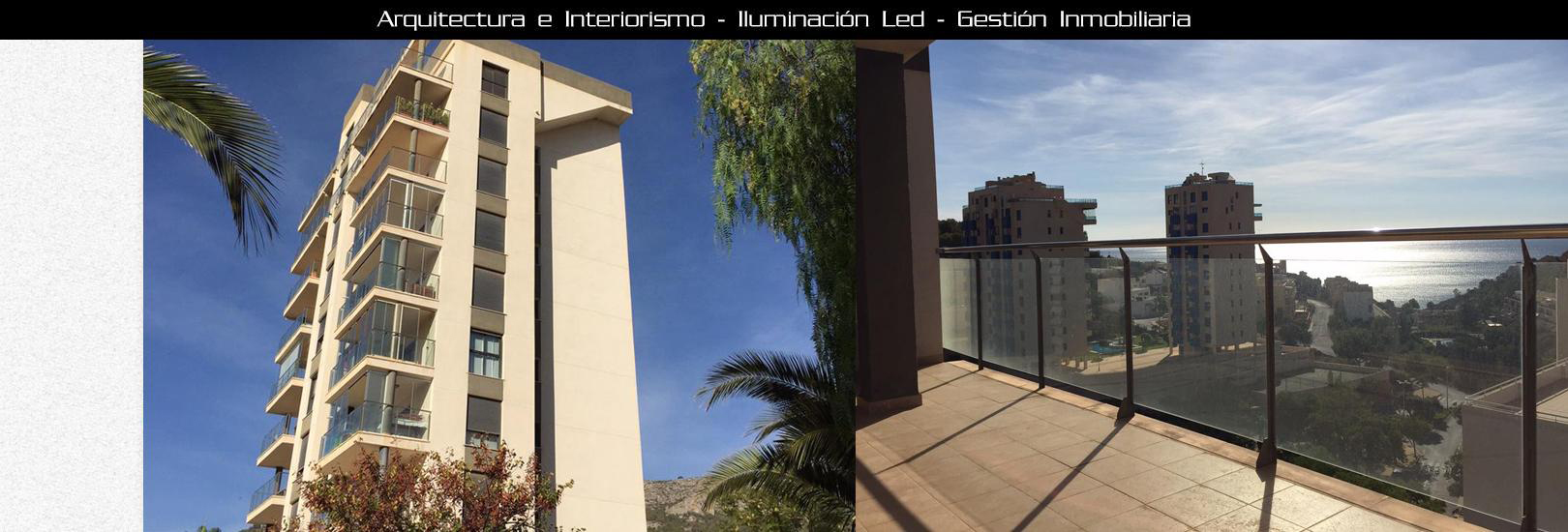

Contact us at Felop Design, and we can answer any questions you may have related to housing design.